Using Feature Snippet Rules, Rich Snippet Rules, Schema, Data Structured defined by Google For Search Engine Optimization

Example of Blog Creation Strategy: Identify what people are searching in Rich Snippet of Google.

When engaging with the other driver’s insurance company post-accident, it’s crucial to exercise caution and adopt a strategic approach to safeguard your interests. Here are practices to steer clear of when communicating with the other driver’s insurance company:

- Providing a Recorded Statement Without Legal Advice:

- Refrain from offering a recorded statement to the insurance company without first consulting your attorney. Recorded statements may be used against you, underscoring the importance of understanding your rights and obligations.

- Admitting Fault or Apologizing:

- Avoid confessing fault or issuing apologies for the accident, even if you suspect your contribution. Allow the investigation to establish liability.

- Accepting a Quick Settlement:

- Exercise caution when presented with a swift settlement offer from the insurance company. Such offers may fall short of covering all your damages, particularly if ongoing medical expenses or future costs are overlooked.

- Signing a General Medical Authorization:

- Steer clear of signing a broad medical authorization granting the insurance company access to your entire medical history. Provide only pertinent medical information tied to the accident.

- Underestimating Future Damages:

- Refrain from underestimating potential future damages like ongoing medical treatment, rehabilitation, or long-term consequences of the injury. Consult with medical professionals to gauge the full extent of your injuries.

- Relying on the Insurance Adjuster’s Assessment:

- Maintain skepticism regarding the insurance adjuster’s evaluation of your claim. Insurance companies may seek to minimize payouts, underscoring the need for an independent assessment of your damages.

- Ignoring Your Own Insurance Policy:

- Avoid neglecting to inform your insurance company about the accident. Your insurance policy might offer coverage or assistance during the claims process.

- Failing to Document Evidence:

- Steer clear of overlooking evidence collection at the accident scene. Capture photos, gather witness details, and compile relevant evidence supporting your claim.

- Settling Too Quickly:

- Resist the temptation to settle your claim hastily. Some injuries may not surface immediately, and an early settlement could hinder seeking compensation for future medical expenses.

- Not Seeking Legal Advice:

- Essential to consult an attorney before making significant decisions or accepting settlements. Attorneys can offer guidance on your rights, assess your claim’s value, and negotiate on your behalf.

Remember, insurance companies operate as businesses aiming to minimize financial liabilities. A cautious, informed approach, coupled with legal advice, enhances the likelihood of receiving fair compensation for your injuries and damages. If uncertain about navigating the process, consulting a personal injury attorney is recommended.

Previous Success Stories Using This Method

Improved from 144 organic clicks per day to 992 organic clicks in 3 months

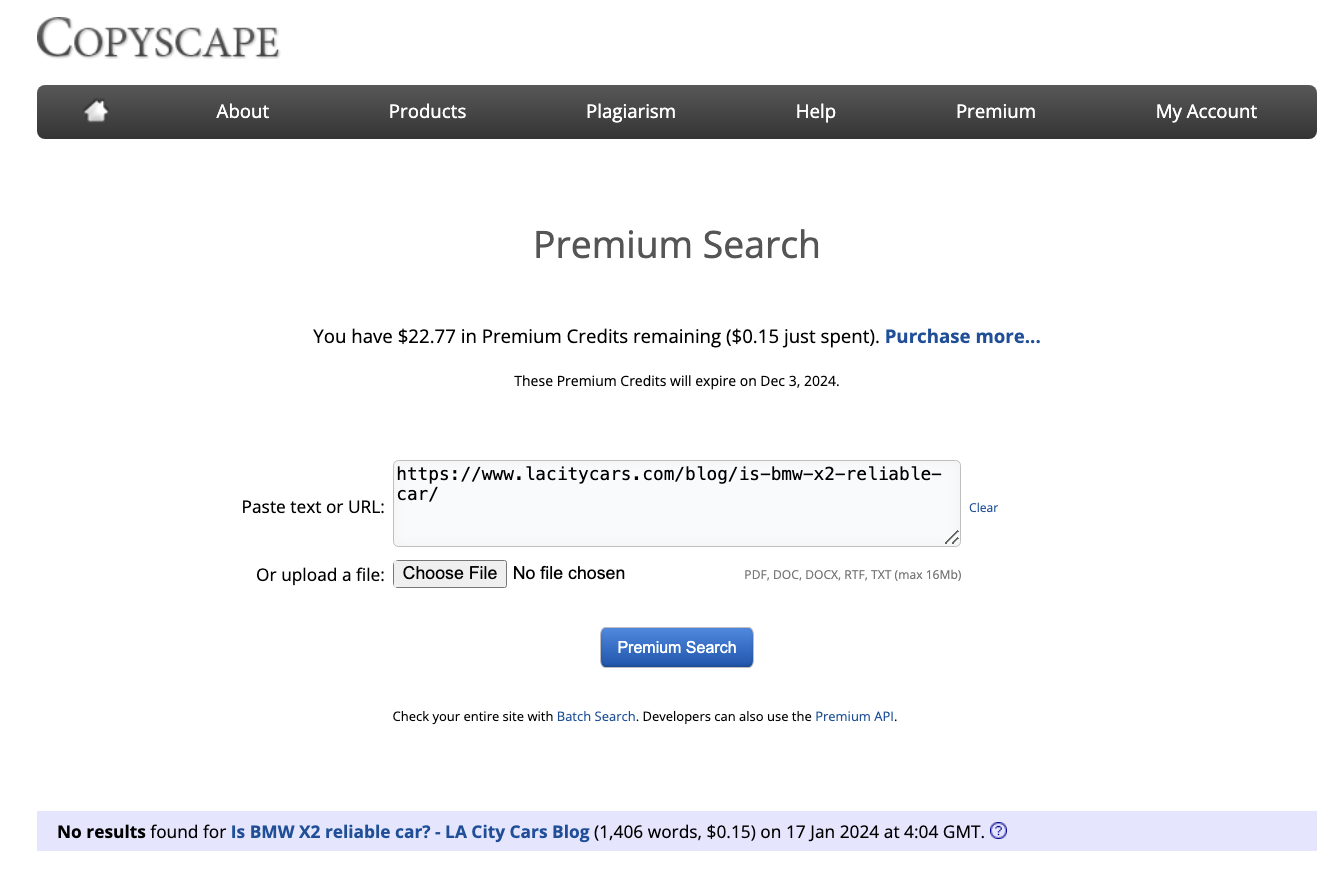

Blog Posts at: https://www.lacitycars.com/blog/all-blog-post/

Used these Blog Posts as Social Media Posts like Facebook, GMB and Twitter

Quality of Blogs:

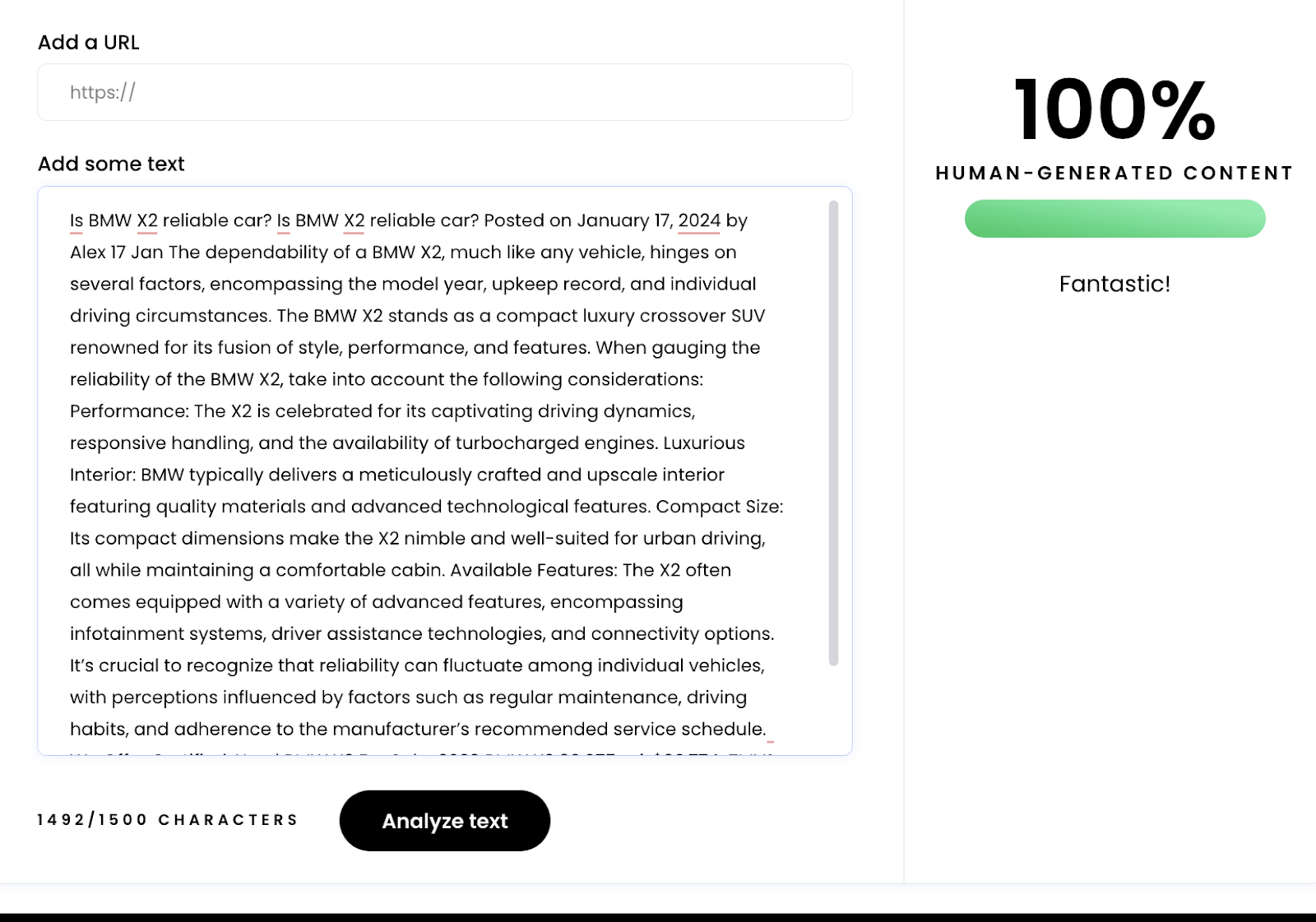

I am using a proprietary type of AI that can pass Human Generated Test