Using Feature Snippet Rules, Rich Snippet Rules, Schema, Data Structured defined by Google For Search Engine Optimization

Example of Blog Creation Strategy: Identify what people are searching in Rich Snippet of Google.

Insurance, while designed to offer coverage in the aftermath of an accident, operates within the context of profit-driven motives for companies. Car accident claims lawyers highlight reasons why your car insurance may not consistently align with your interests:

- Profit Motive: Insurance companies, operating as profit-focused businesses, may seek to minimize payouts to bolster their financial standing. Adjusters could aim to settle claims for amounts below their actual value.

- Policy Limitations: Understanding the intricacies of your insurance policy is crucial. Policies come with limitations and exclusions, and insurers might exploit these terms to curtail payouts.

- Claims Process Complexity: The claims process, involving paperwork, documentation, and negotiations, can be intricate. Insurance companies may exploit this complexity, making it challenging for policyholders to navigate the process.

- Negotiation Tactics: Trained negotiators within insurance companies may employ tactics to convince claimants to accept settlements lower than deserved. Seeking legal representation helps balance the negotiation dynamics.

- Denial of Claims: Insurance companies might deny claims based on policy interpretations or alleged violations, leading to disputes and delays in compensation.

- Third-Party Claims Handling: When another party is at fault, their insurance company may prioritize their policyholder’s interests over yours, potentially creating an imbalance in the pursuit of fair compensation.

- Delaying Tactics: Deliberate delays in the claims process are a strategy by insurance companies, aiming to induce frustration or desperation in claimants, increasing the likelihood of accepting lower settlements.

- Recording Statements: Statements recorded by insurance adjusters can be wielded against you. Adjusters may try to extract statements that could be construed as an admission of fault or downplaying the extent of injuries.

- Undervaluing Damages: Insurance companies may undervalue property damage, medical expenses, or other losses, offering settlements that fall short of fully compensating the claimant.

- Policy Cancellations: Insurance companies may cancel policies for various reasons, potentially leaving individuals without coverage precisely when needed the most.

To safeguard your interests, it’s vital to be well-informed about your policy, thoroughly document the accident, and consider seeking legal advice, particularly in cases involving significant damages or disputes. Consulting with a car accident claims lawyer can offer valuable guidance in navigating the insurance process and pursuing fair compensation.

Previous Success Stories Using This Method

Improved from 144 organic clicks per day to 992 organic clicks in 3 months

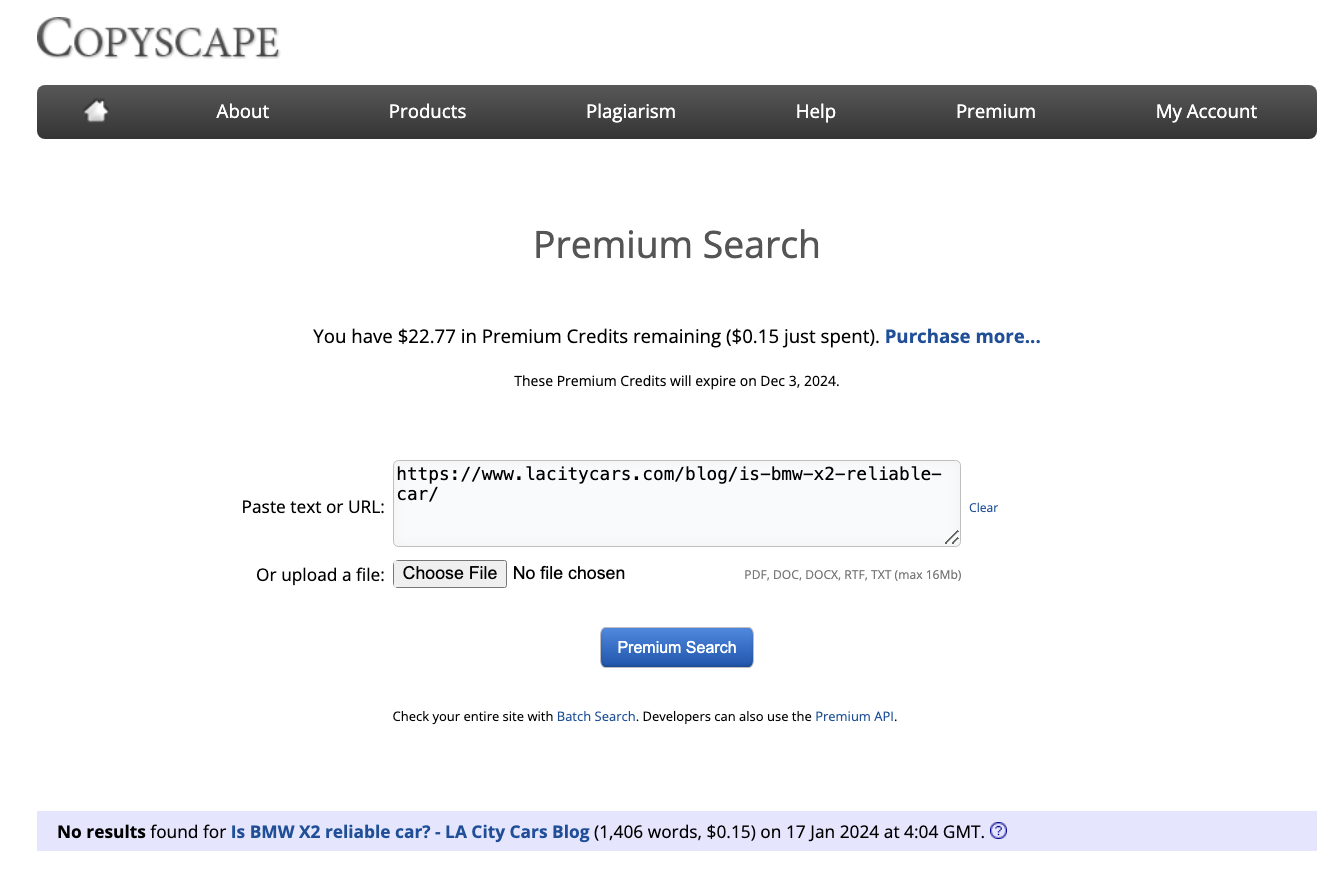

Blog Posts at: https://www.lacitycars.com/blog/all-blog-post/

Used these Blog Posts as Social Media Posts like Facebook, GMB and Twitter

Quality of Blogs:

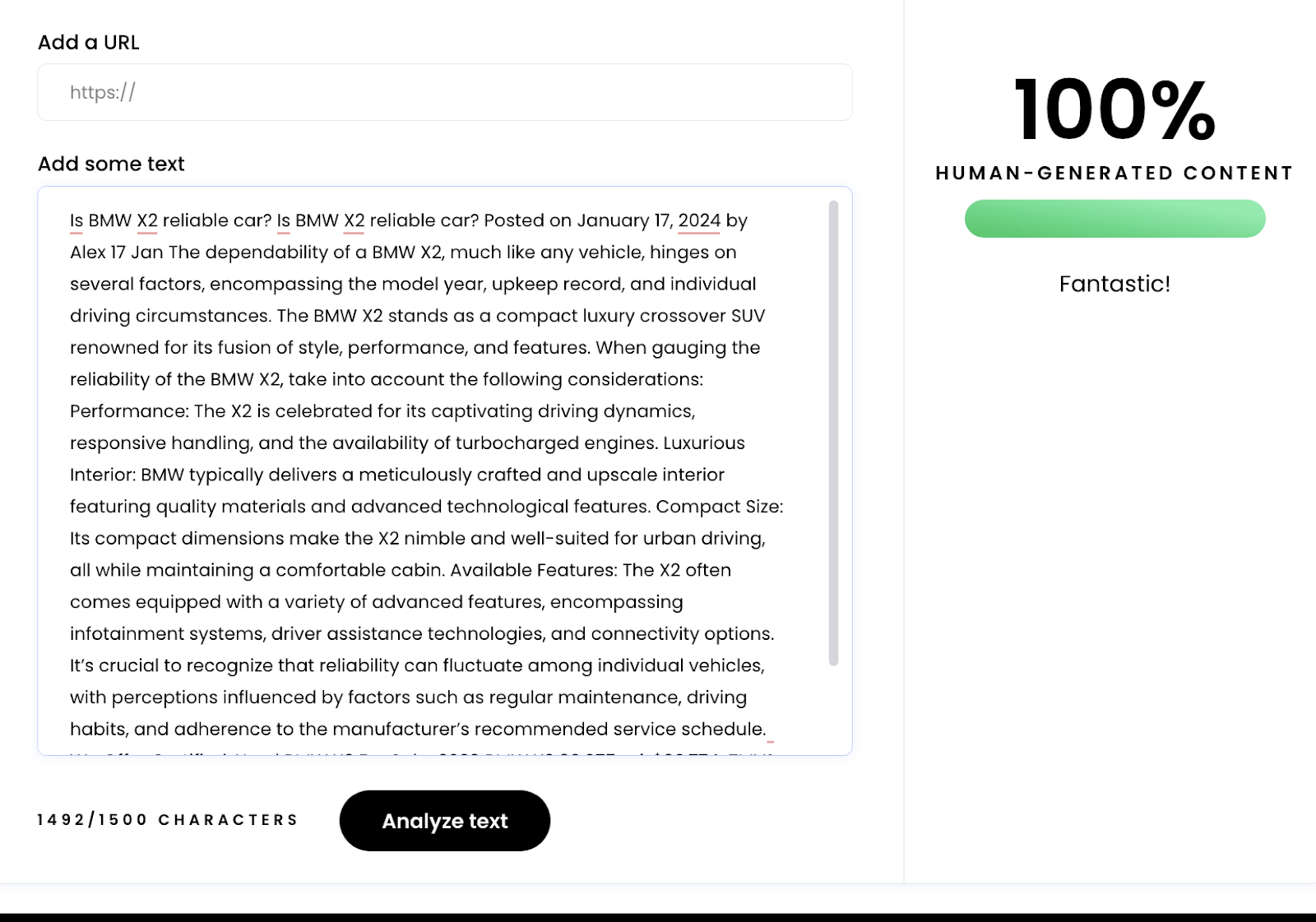

I am using a proprietary type of AI that can pass Human Generated Test