Using Feature Snippet Rules, Rich Snippet Rules, Schema, Data Structured defined by Google For Search Engine Optimization

Example of Blog Creation Strategy: Identify what people are searching in Rich Snippet of Google.

While insurance is designed to provide coverage and support in the event of an accident, it’s important to recognize that insurance companies are profit-driven entities. Here are reasons why your car insurance may not always be entirely on your side, according to car accident claims lawyers:

- Profit Motive:

- Insurance companies are businesses aiming to make a profit. This means they may try to minimize payouts to maximize their bottom line. Adjusters may seek to settle claims for less than the full value.

- Policy Limitations:

- Your insurance policy has limitations and exclusions. Understanding the fine print is crucial to knowing what is and isn’t covered. Insurance companies may use policy terms to limit payouts.

- Claims Process Complexity:

- The claims process can be complex, involving paperwork, documentation, and negotiations. Insurance companies may use this complexity to their advantage, making it challenging for policyholders to navigate the process.

- Negotiation Tactics:

- Insurance adjusters are trained negotiators. They may employ tactics to persuade claimants to accept lower settlements. Seeking legal representation can level the playing field.

- Denial of Claims:

- Insurance companies may deny claims based on policy interpretations or alleged policy violations. This can lead to disputes and delays in compensation.

- Third-Party Claims Handling:

- In situations where another party is at fault, their insurance company may not act in your best interest. Their primary loyalty is to their policyholder, not to you.

- Delaying Tactics:

- Insurance companies may intentionally delay the claims process, hoping that claimants become frustrated or desperate and accept a lower settlement.

- Recording Statements:

- Recorded statements made to insurance adjusters can be used against you. Adjusters may try to elicit statements that can be interpreted as admission of fault or downplaying injuries.

- Undervaluing Damages:

- Insurance companies may undervalue property damage, medical expenses, or other losses, offering settlements that do not fully compensate the claimant.

- Policy Cancellations:

- Insurance companies may cancel policies for various reasons, leaving individuals without coverage when they need it the most.

To protect your interests, it’s crucial to be informed about your policy, document the accident thoroughly, and consider seeking legal advice, especially if the claim involves significant damages or disputes. Consulting with a car accident claims lawyer can provide guidance on navigating the insurance process and pursuing fair compensation.

Previous Success Stories Using This Method

Improved from 144 organic clicks per day to 992 organic clicks in 3 months

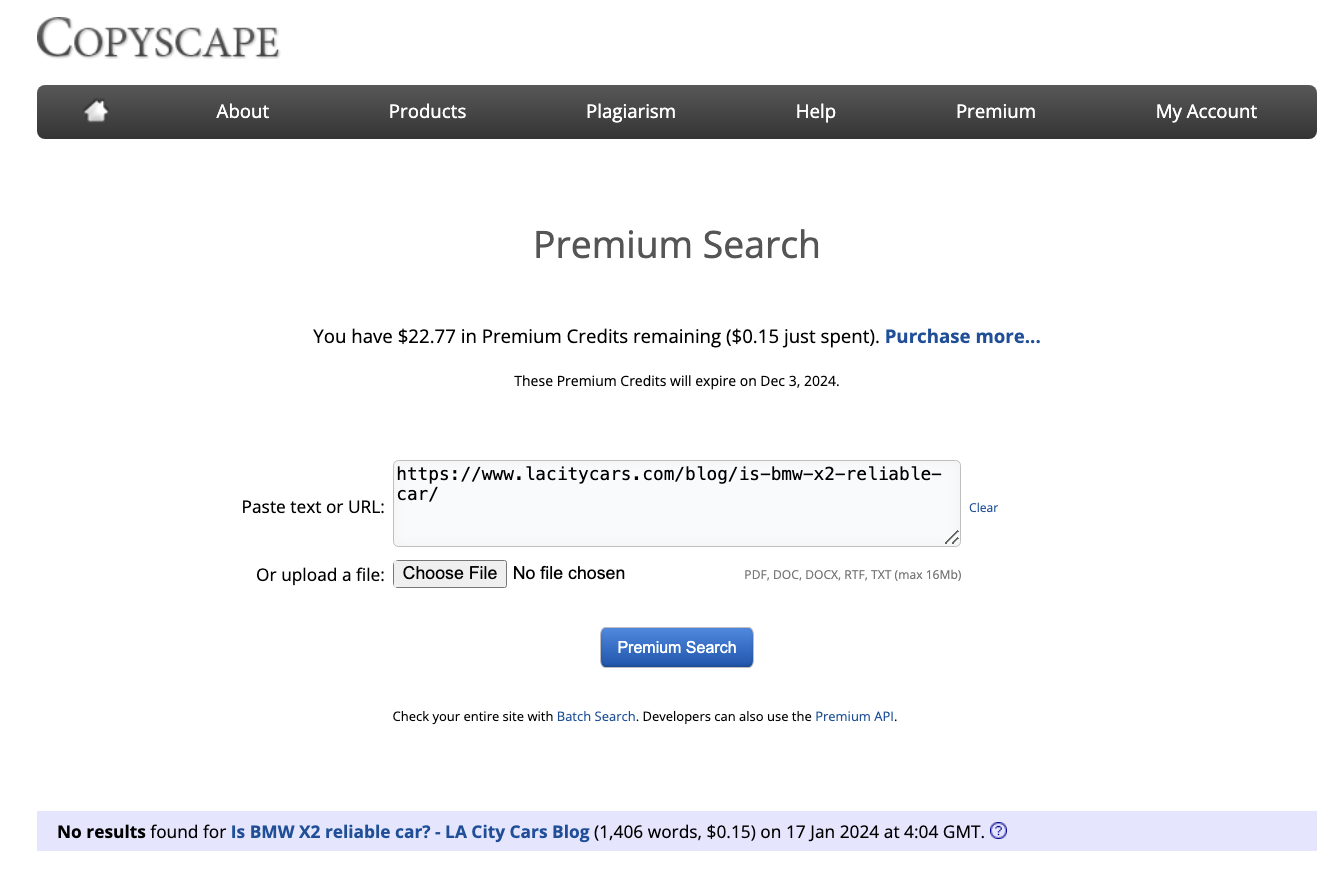

Blog Posts at: https://www.lacitycars.com/blog/all-blog-post/

Used these Blog Posts as Social Media Posts like Facebook, GMB and Twitter

Quality of Blogs:

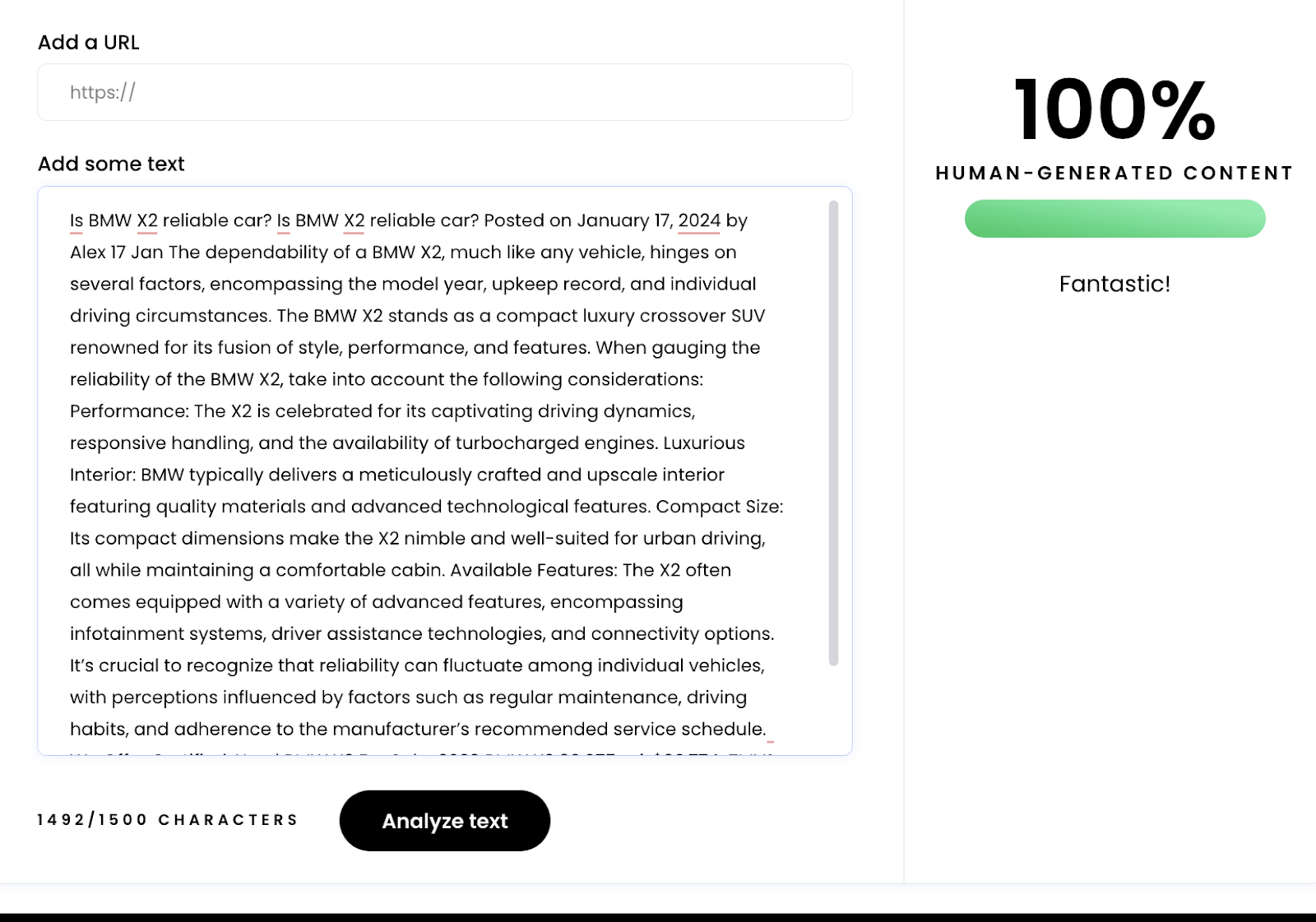

I am using a proprietary type of AI that can pass Human Generated Test